Local entrepreneurs, Capital Coaching program honored in 2024 IEDC yearbook

CDFI Friendly is proud to be recognized in Entrepreneurship Indiana (PDF, 405MB), the 2024 Yearbook of the Indiana Economic Development Corporation (IEDC). The yearbook profiles 100 entrepreneurs and support organizations from across the state – including four from South Bend.

Building for Impact: Facility and Finance Planning Strategies for Nonprofits

Last week, CDFI Friendly South Bend joined with local nonprofit partners to host such a workshop at the Studebaker National Museum.

Made possible by a sponsorship from PNC Bank, the interactive session focused on the resources and support available to help nonprofit organizations advance their missions.

Capital Coaching program recognized by Indiana Economic Development Corp.

CDFI Friendly South Bend’s Capital Coaching program was recently recognized by the Indiana Economic Development Corporation (IEDC) at its inaugural Entrepreneur Support Organization (ESO) Summit.

CDFI Friendly South Bend’s executive director Sam Centellas was invited to share our Capital Coaching program with ESO representatives from across the state during a panel discussion on Access to Capital.

CDFI Friendly announces expansion into Southwest Michigan

CDFI Friendly is proud to announce an expansion of its programs into southwest Michigan. Executive Director Sam Centellas recently broke the news before a full house at the October Chamber Buzz Event hosted by the Greater Niles Chamber of Commerce.

Special Events with IFF/PNC on 12/3/24

We are excited to announce that IFF (CDFI) is coming to South Bend on Tuesday, December 3rd for two exciting programs! The registration for both events is FREE through partnership with IFF and a sponsorship from PNC Bank.

Nuevo programa de préstamos presentado durante un seminario web en español

CDFI Friendly South Bend y Everwise Credit Union organizaron una presentación virtual para explorar los recursos financieros que están disponibles para empresas latinas. La presentación, realizada en español, tuvo como objetivo cerrar las brechas que a menudo enfrentan los empresarios hispanos.

Flagstar provides $100k boost to Capital Coaching, other CFSB programs

Flagstar Bank presented CDFI Friendly South Bend with a check for $100,000 Tuesday – a community development investment that will expand the capacity and reach of our Capital Coaching and other programs.

"Flagstar Bank’s investment allows us to reach more underserved communities,” said Executive Director Sam Centellas.

CDFI Friendly South Bend closes gaps in underdeveloped South Bend neighborhooods

South Bend needs housing. So why do so many neighborhoods remain underdeveloped? One problem known as the "appraisal gap" keeps developers from getting financing.

We’re filling those gaps more than ever before. Check out the video for more.

What’s Next for Beauty Hive?

We first told you about Beauty Hive back in 2021. Now, they’re growing again!

Owner Willie Dearing says it feels like a dream, but she’s one step closer to her ultimate goal: the moment when she knows she won’t have to work for other people anymore.

Webinar: Credit Improvement Strategies for South Bend Business Owners

We’ve teamed up with Allies for Community Business to offer the Credit Builder program, which identifies eleven important startup activities and pairs participants with a Business Coach to help complete them.

In this recent webinar, A4CB shared how entrepreneurs who have completed those startup activities — such as creating a business plan or opening a business bank account — are usually positioned for greater success than those who have not.

CFSB celebrates two-fold lending increase, other 2023 progress

Thanks to all who joined us on Zoom for the release of our Annual Report. In 2023, we celebrated a two-fold increase in overall lending, developed two new lending programs, and launched a coaching program. Read more about these highlights, or see the recorded presentation here…

CFSB Introduces Capital Coaching

This morning, more than 30 local entrepreneurs and small business hopefuls attended the Steps to Business Success webinar, where CDFI Friendly South Bend introduced our newest program, Capital Coaching. Together, the webinar and the Capital Coaching program will help new business owners start their businesses strong, and maximize their chances of being approved for financing.

CFSB celebrates pedal trolley startup

South Bend’s new entertainment attraction turns heads everywhere it goes.

The Jumpoff is South Bend’s first pedal trolley. Though the entrepreneurs were initially unable to secure startup funds from traditional lenders, CDFI Friendly South Bend helped connect the entrepreneurs to alternative financing.

“Entrepreneurs – especially minority entrepreneurs – we don’t have assets. We have debt, but we don’t have assets,” Co-owner Rhonda Douglas explains. “So we have to talk about it. We have to not make it a secret, because everybody needs help.”

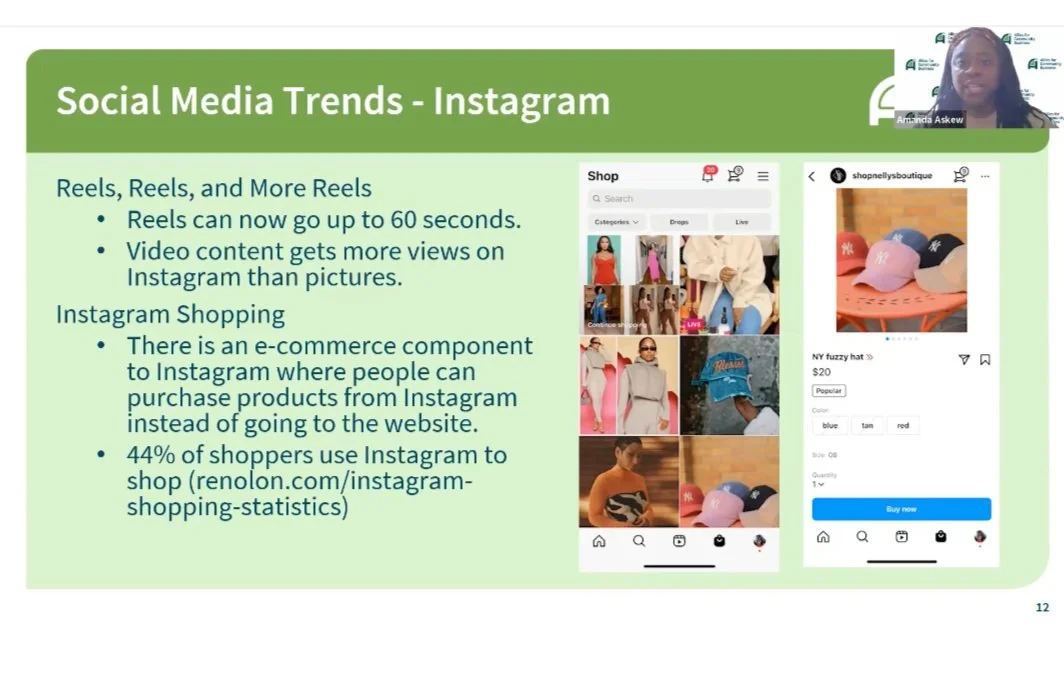

Webinar: Social Media Strategies for Entrepreneurs

Nearly 4 billion people use social media daily. Did you know more than half of them use social media to research new products and businesses?

On June 27, CDFI Friendly South Bend co-hosted a Social Media Strategy webinar, where Amanda Askew with Allies for Community Business shared tips for entrepreneurs to maximize social media’s potential to help reach their business objectives. See the replay…

Winning ideas: CFSB pitches multi-pronged approach to increase housing development

On a snowy Saturday morning in January, more than a dozen local thinkers convened at the South Bend Technology Resource Center to pitch their ideas for alleviating South Bend’s housing crisis.

By the time it was done, three of them – including CFSB’s own executive director Sam Centellas – had taken top honors. “These housing problems are complicated,” admits CFSB executive director Sam Centellas. “There have to be multiple prongs to the solution.”

CFSB celebrates five-fold increase in local CDFI lending, other impacts

In 2022– our first full year of steady leadership – CDFI Friendly South Bend facilitated over $4.3 million in total lending to local businesses and organizations.

Most notably, $1.2 million of that figure came from Community Development Financial Institutions (CDFIs). That’s an exciting five-fold increase over the 2005-2019 annual average.

Webinar: Indiana Black-Owned Business Loan Fund

On February 27, CDFI Friendly South Bend co-hosted a webinar to promote the new Indiana Black-Owned Business Loan Fund.

Indiana-based CDFI Bankable shared the details on how this new program aims to close the wealth gaps in our community with loans of up to $50,000 for small businesses.

Property Bros LLC and CDFI Friendly

Jordan Richardson grew up in a neighborhood where investment was not happening. Jordan, the principal of Property Bros LLC, decided he could help be the difference he saw was needed.

South Bend nonprofits showcase energy-saving upgrades

You’ve probably heard that money doesn’t grow on trees. But as the leaders of some South Bend nonprofits might tell you, it can come from the sun.

At least that’s what these mission-minded organizations are banking on, with the help of a new energy savings initiative co-sponsored by CDFI Friendly South Bend.

The Energy Assistance Solar Savings Initiative, or EASSI, helps local nonprofits, schools, and other community organizations make energy efficiency upgrades to their facilities. CDFI Friendly South Bend helps participants understand when taking on debt to finance these upgrades makes good sense.

CFSB helps local nonprofit finance its mission

Construction is now underway on the first small-scale, multi-family development in decades to be built in South Bend’s Near Northwest Neighborhood, thanks in part to lending assistance from CDFI Friendly South Bend.

“A nonprofit executive is focused on their mission,” says CFSB Executive Director Sam Centellas. “[W]e help the nonprofit stay centered on their community impact without having to worry about the intricacies of different types of finance…”